Introduction (What and Why)

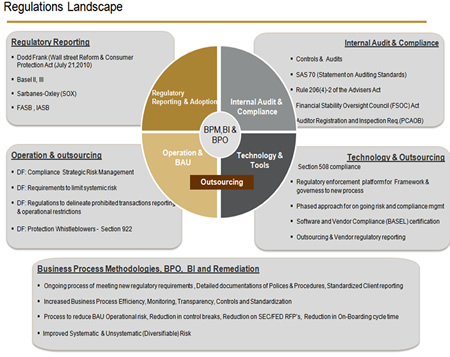

The recent financial crisis and economic downturn has shown that there is a great need for a properly resilient and robust financial/banking system. This need for stability has prompted the banking industry to undergo drastic changes. Financial firms are adjusting business operations in order to be compliant with increased regulatory demands. Naturally, this adjustment has led to higher operating costs. Falling profits associated with this regulatory squeeze can be ameliorated by strategic adherence to cost cutting methodologies – namely Business Process Management (BPM), Business Process Outsourcing (BPO), and Business Intelligence (BO).

- The 2007-2008 financial crisis exhibited an expansion and then a contraction of the balance sheet of the banking system and forced regulators to raise an important question: “how do we stabilize our banking system in order to be able to survive similar crises?”

- The rapid rise in regulatory and compliance mandates has forced financial organizations to re-think and re-evaluate their traditional way of doing business.

-

- In June 2009 President Obama introduced a proposal for a “sweeping overhaul” of the United States financial regulatory system, a motto best depicted by “Dodd-Frank Wall Street Reform and Consumer Protection Act”, which was signed into law on July 21, 2010. The “Dodd-Frank Act” added to the list of existing regulatory and compliance initiatives like Sox, Basel II, III , SAS 70, Section 508 compliance etc……

Key Aspect of Regulatory Regulation (Who and Where)

Dodd-Frank introduced significant changes to the financial industry. These changes include the establishment of a prudential supervision framework, and a number of new requirements and limitations on business activities. Below is a list of reforms and affected parties (exhibit A), and the associated complexities and concerns for stakeholder operating modes (exhibit B), and the effect on employer/employee relations (exhibit C).

- Reforms for Financial Institutions & Regulatory Entities

- Collins Amendment, Enhanced Prudential Standards

- Volcker Rule, OTC Derivatives and Insurance

- FDIC Insurance

- Improving accountability and transparency in the Financial System

- Too Big To Fail (unwinding of collateral) & Systemic risk

- FSOC (Financial Stability Oversight Council) & Federal Reserve

- Bank Supervision & Investor reforms

- Hedge Funds, Private Equity Funds, and Institutional Investors

- SEC, Investor Protection and Credit Rating Agencies

- Consumer Financial Protection & Consumer reforms

- Complexities to Business & Operational Model

- Practical Implementation is a lot more complex

- Lots of unknown unwritten rules

- Significant interconnection between regulator & responsibilities (PCAOB)

- Significant pressure on bank’s profitability (such as trading impact)

- Reform of operational and legal entity structures

- Hedge funds, Derivatives and insurance industry complexities

- Custody business (The amended rules of custody and custodianship Rule 206(4)-2 of the Advisers Act)

- New regulation to delineate prohibited transaction

- Rethinking to limit systemic risk with traditional outsourcing models

- Employee/Employer Relations

-

- Employment Law

- Sox Act 2002 & Dodd Frank Section 922 to protect whistleblowers

- Increase in scope of Vicarious Liability

- Relationship Governance and Termination Management

- Contractual Design and Risk allocations

The complexities and expenses associated with exhibits A through C can be successfully mitigated through organizational adherence to BPM, BI, and BPO.

Accepting changes and Risk Mitigation (How and Benefits $$)

The Initial reaction of organizations is to find ways to meet baseline requirements for regulatory & compliance initiatives. This often entails establishing a robust system (Policy and Procedure system) to meet specific regulatory compliance needs.

Here are some of the strategic options for larger financial organizations to help incorporate regulatory changes in coming year. These options are geared for companies to start planning for organizational transformation, reducing overall cost of regulatory implementation. The traditional outsourcing model does not involve legal liability of service providers for legal wrongdoing by their enterprise customers.

Regulatory changes – 360 Strategic Transformation Road Map

Conclusion:

The impact of the Dodd-Frank Act will continue to evolve over time as regulators study the requirements of the Act and determine the appropriate framework for implementation. The resulting implementation of hundreds of rules over the next few years will certainly impact the profitability of the financial industry. However, managerial utilization of BPM, BI, and BPO will soften the impact of increased regulation on financial firms’ bottom line.

There are multiple ways to incorporate these changes and it is hard to define a specific implementation schema. Successful adaptation of these practices depends on financial institution size, culture, exposure, flexibility to adapt changes and balance sheet strength.

BPM, BPO are an ongoing management practice, not a one off project to final target. Each business and process must be guided along the process maturity model. Every step in maturing BPM, BPO capabilities leads toward optimization and improvement to core processes.

References & Assumptions

- Used google.com – Web Search for secondary information

- SEC.gov

- http://www.sec.gov/about/laws/wallstreetreform

- DF- Section 943(2) –SEC rule 15Ga-1- Securitiser

- DF- Section 943(1) – SEC rule 17g-7

- Dodd-Frank Wall Street Reform and Consumer Protection Act -111-112, 12 U.S.C. – 5321-5322.

- http://www.sif.admin.ch/dokumentation/00514/0

- http://banking.senate.gov/

Disclaimer: This educational article is provided purely for your information only and you should check other information before taking any action based on any of the content in these articles. This document is not a legal interpretation or advise in any form. The authors or any affiliate does not make any claims of legal advice or support for the assumption & information contained in article or any of the site’s articles