A recently published article entitled “Business Capability Architecture Is the Tie that Binds All” discussed how to use business capabilities to tie business strategy, enterprise change, and project portfolio prioritization. We concur that strategy, enterprise change, and portfolio management are managed more effectively using business architecture, and agree that capabilities are a component of business architecture. However, we view the article’s notion of “business capability architecture” as being incomplete. We will discuss why this concept is incomplete and how it can be extended through value mapping.

The core of the business architecture is comprised of business capability, organization, information, and value streams. These four business domains enable representation of complex business perspectives for large-scale organizations on an enterprise scale. This enterprise perspective is essential to turning enterprise strategy into actionable results and enabling portfolio management, change management, and other priority business objectives. Strategy, product, stakeholder, initiative, and related business perspectives are incorporated into the business architecture by mapping and aligning these concepts with the four core business domains. Collectively, these views enable management to assess challenges, evaluate resolution options, predict change impacts, and perform other types of strategy and detailed planning.

The “Tie that Binds” article introduces a concept called the business capability architecture (BCA). The article positions the BCA as a framework for interpreting and enabling business strategy and business initiatives. We believe that the concept of value delivery should be elaborated using value streams and value networks. These value oriented perspectives are linked to capabilities to articulate how those capabilities are used to deliver stakeholder value. If this value oriented perspective is ignored, the ability to leverage business capabilities is significantly sub-optimized. This in turn creates a scenario where an organization makes an investment in capability mapping but ends up struggling to derive business value from that investment.

With the addition of the value mapping perspective, it becomes easy to show how multiple capabilities are used in delivering stakeholder value, an essential perspective in evaluating strategy, change management, and portfolio management impacts. A stakeholder is defined as “An internal or external individual or organization with a vested interest in achieving value through a particular outcome.” Consider what A Guide to the Business Architecture Body of Knowledge™ (BIZBOK® Guide) says about standalone capabilities.

“Business capabilities alone are not enough to fully empower a business to address near-term and long-term issues and challenges. Business capability deployment can be challenged if there is not a clear view of stakeholder engagement or a vision as to how stakeholder value will be achieved.”

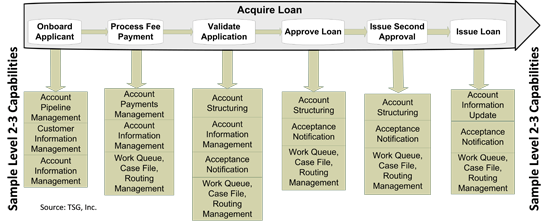

The value of stakeholder value analysis within business architecture is shown in figure 1, the Value Stream / Capability Cross-mapping Blueprint.

Figure 1: Value Stream / Capability Cross-mapping Blueprint

Figure 1 shows how capabilities such as Account Structuring are used in the Acquire Loan value stream. The value stream is triggered by a person requesting a loan. Many of these same capabilities are used in numerous other value streams where a customer may what to pay off a loan or restructure a loan. The collective perspective of these value streams tied to enabling capabilities comprise an essential aspect of of business architecture.

Capabilities themselves do not represent a network. The network must show how the capabilities relate to each other, to the organization and to the value stream. The notion of a capability as a hexagon and of the network as a tessellation of a plane is visually appealing, but is frustrated by the variable number of relationships between capabilities (not always 6) and by the fact that it will be visually difficult to make all of the adjacency relationships work. We prefer a more conventional diagrammatic approach which allows multiple views, so that by appropriate view selection, the business architect can focus on the question at hand.

The article states that “a series of BCAs mapped together is the most efficient way of describing how enterprises are optimally built”. We believe that the “efficiency” and “optimality” are grounded in the analysis of these linkages between strategies, value streams, capabilities, organizations and information. Unless value streams are incorporated and tied to strategy, it will be difficult to see which capabilities are more important and which capabilities are less important in realizing a strategic objective. That this perspective is important has been unquestioned since the publication of Porter’s work on competitive strategy.

Consider the following scenario. A customer obtains a loan via the Acquire Loan value stream. That same customer then misses payments, which triggers the Default Loan value stream. The customer then initiates the Restructure Loan value stream to prevent the default from occurring. Consistency of usage for account structuring and other capabilities across these value streams is important to understand how they are used in very different value context scenarios. In the absence of these scenarios, determination of how to improve, deploy, or leverage capabilities is lacking – along with the ability to focus investments on stakeholder value delivery.

We would argue that Business Architecture provides a richer concept model to support the analytic and synthetic methods used to help business executives formulate and execute strategy.

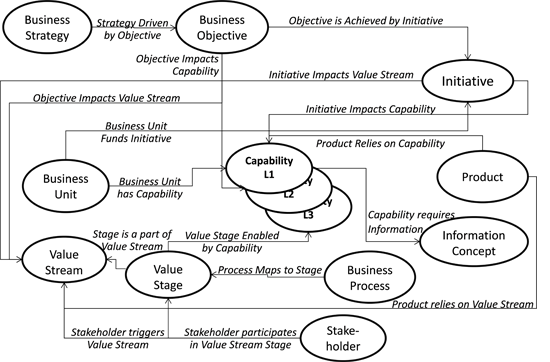

Figure 2 depicts the Business Architecture concept model.

Figure 2: Business Architecture Ecosystem Model

Figure 2 shows how capabilities enable value streams and value delivery. The value stream focus also provides a context for strategic planning, stakeholder engagement, and product planning. Value streams also provide a framework for business process governance, as shown by the value stream stage / process relationship in figure 2. Capabilities, which enable value streams, have a direct relationship to information, business unit, and product. Finally, initiative investments can be focused on a combination of capabilities and value streams, ensuring that there is a direct tie into project investments and stakeholder value delivery.

The primary network of capabilities is defined by relationships imposed by the Value Streams and by the notion that communication of value between capabilities in a value stream is usually accompanied by or realized by the communication of information. The pattern of communication of information between capabilities in the context of a value stream is very important in planning how the capabilities will collaborate in order to produce the stakeholder values of the value stream. It is essential to understand these patterns if the value stream is to be supported by IT.

The concept of a business capability and of the network of business capabilities are fundamental in formulating and executing strategy and in monitoring the operations and resourcing of a business. By then building value analysis, organizational structures, strategic objectives and information flows alongside the network of capabilities, the analyst is able to assist the business executive in strategic decision making.