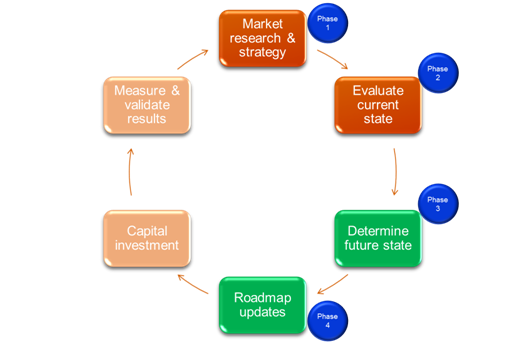

David Starr Jordan, founding president of Stanford University, said “Wisdom is knowing what to do next, skill is knowing how to do it, and virtue is doing it.” It applies to enterprises as much as it does to individuals. Modern enterprises rely on the capital planning process to determine “what to do next” and “how to do it”, which results in change programs for the enterprise. These change programs are then implemented via standard portfolio management processes of the enterprise. Capital planning depends on a clearly defined business strategy and a good understanding of the current state of the enterprise. In the absence of either, capital planning exercises result in misaligned and redundant program portfolios. Figure 1 depicts a view of capital planning & portfolio management processes (notice the cyclical nature). Name and order of these phases may vary between companies.

Figure 1 – Capital planning phases 1 to 4 and portfolio management

Let us examine how business architecture can aid the capital planning process. Phases 1 and 2 determine “what needs to be done”. Phases 3 & 4 determine “how to do it”. Many enterprises can comfortably execute Phase 1 and Phase 2, but find it difficult to execute Phase 3 and Phase 4. Consequently, good intentions are not translated into meaningful actions for the enterprise. Business architecture artifacts namely, capability maps, value streams and other items, are helpful in effectively bridging “what needs to be done” with “how to do it”. Thus, business architects can aid organizations to translate “what needs to be done” into “how to do it”. Does this mean an enterprise can’t execute capital planning successfully without business architect? The answer is “Of course no”.

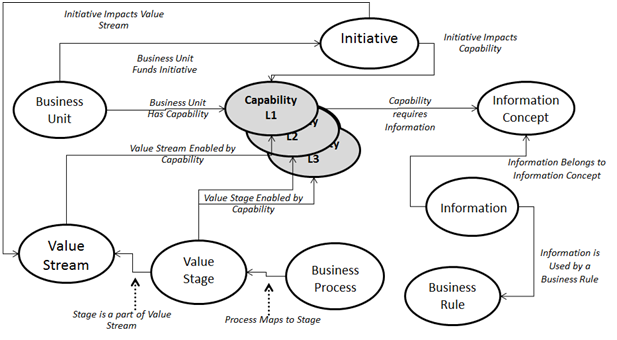

Many enterprises today perform capital planning without the benefit of business architecture. In the absence of capability maps, value maps and other artifacts, enterprises rely on subject matter experts, thereby unwittingly promoting hero culture within the enterprise. There is lack of awareness of common capabilities and no assurance that impact assessments will cover all facets. Hence capital planning quite often results in redundant and misaligned program portfolios. Business architecture can help the enterprise to become more mature at capital planning. Figure 2 shows the value of business architecture in realizing vision and strategy of business units. Business units have vision and strategy. Business units deliver value to customer through value streams. Value streams in turn are enabled by business capabilities. The structure shown in Figure 2 provides a basis for understanding these relationships for planning and deployment purposes.

|

Source: A Guide to the Business Architecture Body of Knowledge (BIZBOK™) – Release 3.0, Part 5 |

Figure 2 – Business Architecture Knowledge Base Mapping[i]

Let us examine each phase in capital planning and value of business architecture.

Phase 1- Market research & strategy: This phase is critical for success in capital planning. A clearly defined business strategy with updates to the product portfolio will be a key outcome of this phase.

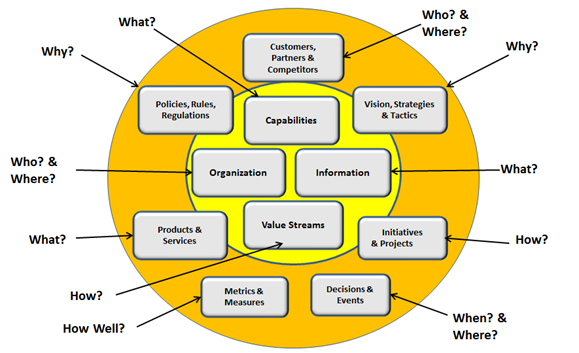

|

Source: A Guide to the Business Architecture Body of Knowledge (BIZBOK™) – Release 3.0, Part 1 |

Figure 3 – Business Architecture Ecosystem[ii]

Depending on the process maturity and available resources, the enterprise may adopt the industry standard strategy formulation process. Participating leaders primarily focus on factors external to the enterprise namely, customers, marketplace, competitors, regulations, brand, products and other items. Key elements of strategic assessments include:

- External assessment

- Internal assessment

- Strategic intent

- Operational results

- Strategic choice

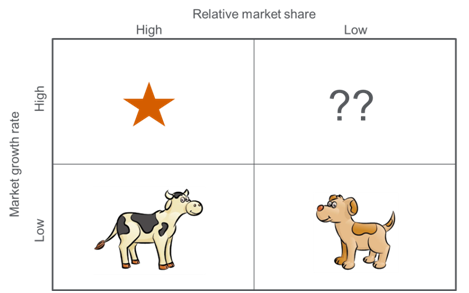

For external assessments, the enterprise could use techniques like provided by the Boston consulting group [BCG] gain-share matrix (refer to Figure 4). The business architect has a consulting role during this phase and needs to leverage business architecture artifacts (in Figure 3) to inform leaders about the current state of the enterprise and apply strategic impacts to each of these areas of the business. Based on an understanding of the business architecture, business leaders could then perform what-if analysis to introduce new products, retire products, expose existing capabilities to the marketplace and engage in similar business scenarios. The business architect can enable iterations of what-if assessments through the presentation of the business in business friendly ways.

Figure 4 – Growth-Share matrix (Source: Boston consulting group)[iii]

Phase 2- Evaluate current state: Enterprises do not frequently revise business strategy and product portfolio in a significant manner. However enterprises do frequently assess performance against strategy and take corrective actions as required. Business architects can enable these assessments by leveraging the artifacts in Figure 2 to develop capability heat maps and identify corrective actions. Based on these assessments, the leadership team can develop goals for change programs. Some benefits of engaging a business architect in this phase are as follows:

- Awareness of common capabilities at a granular level during assessment set the stage for a holistic solution.

- Diagnosis or assessment results can be captured at appropriate level against respective capabilities.

- Capability maps, value streams and other artifacts enable strategic discussions. In the absence of a business architect and these artifacts, assessment discussions can get into irrelevant details and miss the big picture.

It is possible to swap the order of Phase 1 and Phase 2 based on enterprise needs; however, it is better to complete the market research and strategy phase earlier because it:

- Provides focus areas to evaluate current state.

- Identifies prioritized business areas for subsequent impact analysis.

- Avoids “boil the ocean” syndrome by analyzing every corner of the enterprise for opportunities.

Phase 3- Determine future state: After completing Phase 1 and Phase 2, there is a good understanding of “what needs to be done”. As mentioned earlier, many enterprises can comfortably execute Phases 1 and 2, but they find it difficult to execute Phases 3 and 4. One of the key reasons is the lack of organizational knowledge on linkage between strategy and organization/processes/technology. Business architecture fosters this link as represented in Figure2 and Figure 3. This information will enable the “how to do it” discussion.

Business architects should have already captured impacts to value streams and capabilities. How must the enterprise respond? Normally there are multiple options for a future state that support these impacts. Business architects can work with business operations, IT and finance to evaluate options and identify an optimal solution (or future state). Some of the tasks that business architects can do are:

- Propose options for future state by leveraging common capabilities.

- Technology may not be the answer for every impact. Identify options for changes to business process and organizations.

- Evaluate options and present results of the evaluation to the leadership team to achieve consensus on future state.

- Holistically articulate future state for the organization and its processes and technology.

- Capture preliminary dependencies, timelines and constraints.

Phase 4- Roadmap updates:

After achieving a consensus on the future state, the next task is to identify the portfolio of change programs, scope, timelines and dependencies.

Change programs could impact the organization, business processes and technology. Some examples of change programs are:

- Business transformation initiatives

- Business process reengineering for a set of value streams

- Human resource optimization

- Rationalize technology landscape

- Build new BPM solutions

- Focus areas for six sigma and lean

It is tempting to recommend multi-year business transformation initiatives, but we live in the real world. Business leaders are held accountable for quarterly/annual revenue and profitability targets. Marketplace and customer-needs would have changed by the time multi-year transformation initiatives are implemented. So there is little appetite for business leaders to embark on large multi-year business transformation initiatives. During this phase, business architects can participate in discussions with the leadership team to identify:

- Meaningful units of change that can be realized based on financial constraints and readiness of organization to absorb these changes.

- Goal and scope of work for these units of change and formalize into projects/programs.

- Dependencies between change programs.

- Timelines and constraints for these change programs

Business architects can enable these discussions by leveraging information captured at the appropriate level and proper business architecture artifacts.

Conclusion:

As discussed, business architecture provides a well-defined framework for translating “what needs to be done” into “how to do it”. Business architecture promotes common understanding of the enterprise and fosters collaboration. Without business architecture, ideation for capital planning will be more of an art instead of science.

How to measure ROI on Business architecture for capital planning process? Certainly it is difficult to measure ROI. To measure ROI, we need to estimate the quantum of capital that could be wasted through redundant and misaligned programs without business architecture against optimal deployment of capital using business architecture. Assuming we can estimate the former, it requires at least three to five year cycle.

References

[i] Business Architecture Guild.

[ii] Business Architecture Guild.

[iii] Boston consulting – growth share matrix.